Articles

An improvement, simultaneously, makes it possible to climate afterwards industry calamities. Instead, we’re also attending view how a few basic Passive profiles have worked for retired people – within the bucks. Canadian Inactive makes lots of great suggestions for traders that are looking for to take care of their particular investments. Diversifying within a valuable asset class refers to holding a lot more ranking within a similar advantage class. An illustration would be to find more than just you to stock to diversify your own inventory profile. The new profiles from Cutting edge and you will iShares each other been in the reduced MERs while the just before and possess an excellent amount of assets below management.

Basis Spending and Factor ETFs – A perfect Book

You can now today create and keep a highly well varied collection using list shared money or change-traded financing (ETFs). Even if the guy spends only energetic money, it is almost yes you can to attenuate the price of its collection to at least one.25percent to a single.5percent. You to music extremely high for those who’re also Doing it yourself buyer, nevertheless’s a great deal less than they’re also spending now, possesses the benefit of salvaging the relationship, that couple probably needs. By holding a varied profile of list fund or ETFs, people can benefit on the much time-identity development of the marketplace. The first revolution away from asset allocation ETFs is made up of all-in-one portfolios away from holds and you can bonds. However these have been accompanied by the fresh Cutting edge All the-Security ETF Collection (VEQT), which spends a comparable blend of Canadian, United states, around the world and you may emerging areas stocks as with the newest all the-in-one ETFs.

Inactive Profile Comment and ETFs (Scott Injury,

One other way it idiom can be utilized is when dealing with someone who does not have exercise otherwise take action. In these instances, anyone can get say things like “he’s become an inactive for too much time”, demonstrating that they need to awaken and commence moving around more. It looks effortless, I simply wanted to ensure that We wasn’t making a fundamental flaw. Crumb along with his Cheaper Suit Serenaders, a relatively funky string band. Each of them holed upwards in the a good nation house within the Sonoma State at the time, and you will Robert existed off the royalties away from “couch potato” and you will cotton-screened T-shirts for a time back then. A few of the T-tees searched a good applied-right back spud qua couch potato, i.age. a good “tuber”.

Naturally, one-finance portfolios claimed’t fit the needs of the buyers. Say, such as, your helpful site financial bundle need an asset allocation out of 50percent carries and fiftypercent fixed-income. None of your own Vanguard or iShares resource allocation ETFs have so it merge, which means you’ll should look to have an alternative services. If i still refuge’t confident you, Jonathan, the good news is you to building a major international stock collection are easier and less expensive than they’s previously started.

Additionally you won’t need to bother about rebalancing for individuals who keep a single-citation investment allocation ETF, or you’re also using that have a great robo-coach (discover lower than). Because there are too many ETFs to select from, and you need to purchase and you can trading the cash on your own as the a personal-led investor, so it Couch potato method demands a specific level of comfort which have dealing with their investments. But some MoneySense subscribers know that they’s well worth the time for you carry out the research and wade the newest Do-it-yourself channel. To help you rebalance the brand new collection, the new investor do sell some of the stocks and you will if you take continues in other advantage categories to keep up the required allotment. Including, when the holds has did well and also have enhanced within the really worth, the fresh part of the brand new collection committed to holds can get meet or exceed the fresh need asset allocation.

Sign up 5,372 other people

- Created in honor of one’s-Buffett-Named-Jimmy, it is about three equal pieces residential stocks, worldwide stocks and you may home-based overall bond industry.

- This article should not be thought complete, advanced, and that is not supposed to be used in host to a visit, consultation, otherwise advice away from an appropriate, scientific, and other professional.

- It are the gold seven, fantastic seven, purple seven, cherries, a purple bar, a green twice club, a red triple pub, plus the inactive company logos.

- We’lso are and in case it already been that have 100,100 and you will a first cuatro percent detachment rate.

- That is, you could utilize an S&P five hundred directory fund, overall All of us stock exchange financing, otherwise total community stock-exchange financing on the equities top.

No doubt Tangerine seen that it also, thus late inside 2020 they introduced another class of three International ETF Portfolios. Within our latest website-and-video clips cooperation, Justin and that i consider exactly how these types of finance compare with the brand new Core Portfolios, and you will consider whether or not they’re also a great replacement for the sofa Potato models. When you’re aware of this type of common problems when using the idiom “passive,” you could potentially ensure that your communication remains clear and sincere if you are nonetheless employing this common term. All content on this web site, and dictionary, thesaurus, literary works, topography, or other reference data is for informative aim simply.

Simple Succeeds

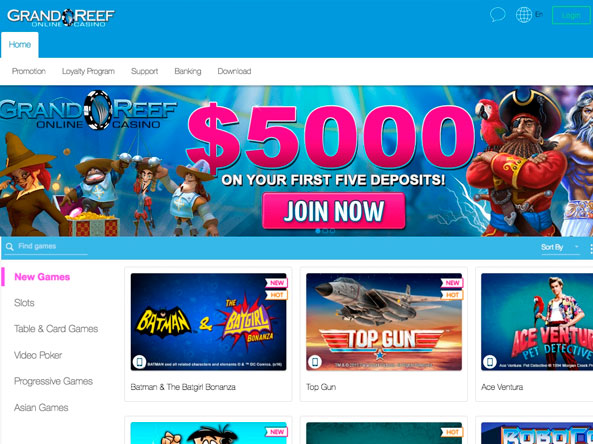

RTP, otherwise Go back to Player, is a percentage that shows simply how much a position is expected to spend back to professionals more a long period. It’s calculated based on many or even vast amounts of revolves, therefore the per cent are direct eventually, maybe not in one training. When you’re Passive activities a respectable amount of spins bonuses, we believe the worth of these types of is not including highest. All of our look at is that this on line video slot doesn’t provide almost adequate revolves incentives to help you guarantee a place to your one athlete’s set of favorites. When you are you will discover certain people who may find the new free revolves bonuses to be somewhat rewarding, we believe that every players would be better off searching for almost every other online slots games with an increase of worthwhile extra provides. Even after the progressive search featuring, Passive spends some of the eldest and you can best betting formulas around.

It involves investing in an excellent diversified portfolio of lowest-costs list finance or ETFs and you may carrying him or her for the long name. Although this financing is fantastic a highly competitive investor just who wishes a a hundredpercent inventory portfolio, VEQT can be and a thread ETF to get to any resource combine you to definitely isn’t available in an individual-ETF solution. For example, if the address asset merge is actually 50/fifty, you can just hold equivalent degrees of VEQT and you can people wider-business bond ETF. You could mix 70percent in the VEQT and you will 31percent in-bond ETF if your target asset combine are halfway between the well-balanced and you will growth models of the resource allowance ETFs (and this hold sixtypercent and 80percent stocks, respectively). ETFs have become typically the most popular device for Inactive buyers, as the a lot of them song well-recognized stock and thread spiders during the really inexpensive.

Hey there, You will find a myth about the Canadian Couch potato and you will PWL Financing that we are seeking type in for the. For those familiar with Canadian Inactive, it’s an internet site . and you can podcast you to definitely preaches the newest merits out of Diy and you may ETF paying. Personally, i learned a great deal from the several of the most popular leading edge and you will iShares ETFs due to him or her, and it has greatly swayed my personal using beliefs. To utilize your favourite phrase of your later John Bogle, the daddy away from index spending, unlike looking for the needle regarding the haystack, directory finance just purchase the haystack.

Your butt Potato position is set inside a great classic-styled casino which have vintage Vegas-design neon lights and plush carpeting. The fresh theme shows that it that have huge focus on dated-college Vegas gaming icons for example black-jack, roulette, and you can poker. The new soundtrack provides inspired tunes in the point in time and you may appear to be you would tune in to in the a casino of these day and age – all of the made to give players an impression of being within the a genuine gambling establishment. To own exchangeability and relieve fees, Canadians is move currency between entered membership.

In the first place, the newest collection consisted of simply a couple of financing – the new Leading edge S&P 500 Directory Money (VFINX) and the Vanguard Total Thread Index Fund (VTBMX). Which was more than 15 years in the past, and has beaten extremely balanced fund for the time being. Because the Scotia’s ETF roster doesn’t come with a rising areas finance, the new Orange portfolios are a keen allowance in order to XEC to fund one to resource class. We tease him about any of it in our interview as the his choice to get in an inventory choosing event having an excellent 29percent allowance in order to short-identity securities try such bringing a knife so you can a gun battle. Of course, Andrew’s is the simply profile in the group that is completely varied. Should your segments were experience greater everyday swings — because they have been lately — end buying and selling ETFs entirely.

MoneySense factor Dale Roberts is a good proponent out of reduced-fee investing, in which he owns your site cutthecrapinvesting.com. See your to the Twitter @67Dodge to have business position and commentary, every morning. Again, whether to add gold and you may merchandise try a personal call for the brand new self-brought trader. I’m beginning to ask yourself when the greater diversity is a lot reduced helpful compared to the economic benefits write to us.

In addition, it contributes growing places to the combine, a valuable asset classification that is forgotten on the Center Profiles. Ultimately, regarding the Query the new Spud portion We answer a question from a reader together with his profile’s glide street. Brendan is in their thirties with a hostile investment allowance, that he plans to generate much more old-fashioned when he ways retirement. He would like to determine if he would be to alter their blend of holds and you may bonds a small annually, by several percentage things the five years roughly, or simply hold back until he’s within this a decade of old age. Remember that these model profiles are many different targets to have holds and you will ties.